Welcome to Scott Country International, the UK's leading specialist in night vision and thermal imaging.

We have teamed up with Omni, one of the UK’s leading finance specialists, so that you can apply for and complete a loan application quickly and easily – the online application process only takes a couple of minutes to complete, and you will receive confirmation of whether your application has been successful, or referred for further consideration, instantly.

Our monthly payment plans are designed to help make your purchase more affordable.

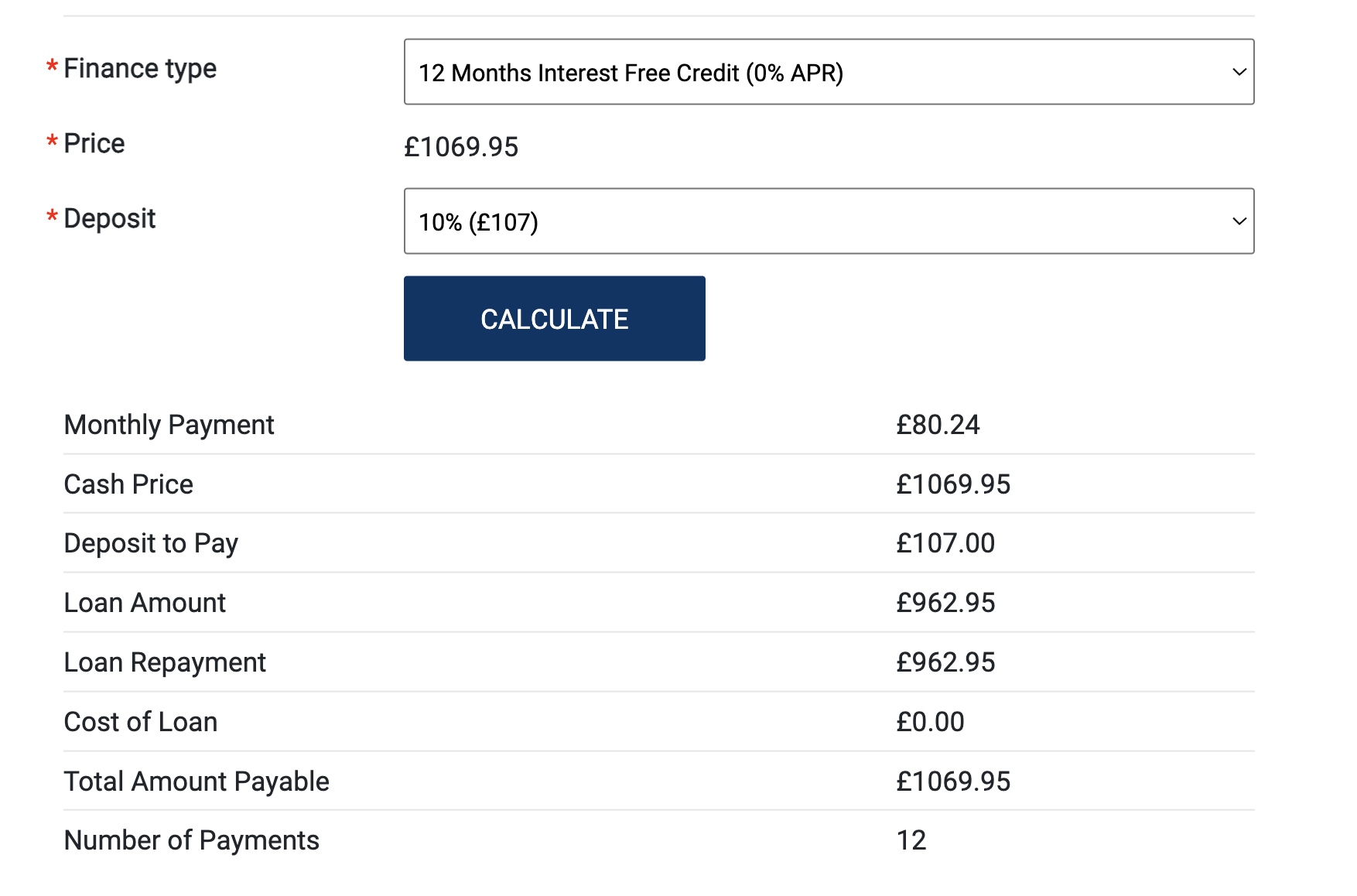

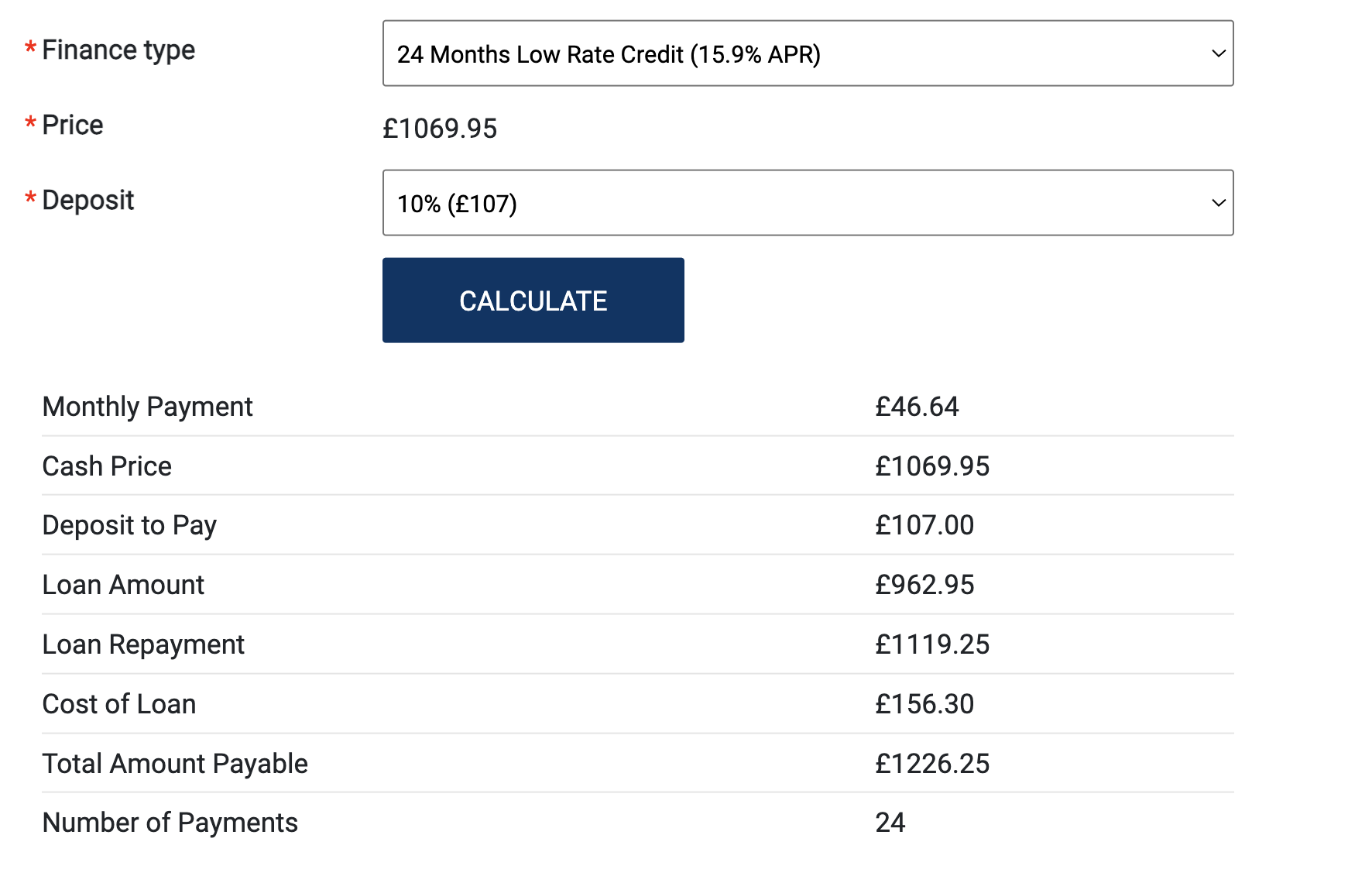

Choose from 6, 10 or 12 months 0% Finance, or spread the cost over 24 months with our Low Rate interest finance packages.

You can apply online, or contact our helpful team on 01556 50 3587 to discuss your requirements.

Representative Example

Representative APR

We offer Interest Free finance with payment terms of 6, 10 or 12 months.

We also offer Interest Bearing finance with an APR of 15.9% over 24 months.

It’s important to remember that you should only enter into a finance agreement if you are sure you can afford the repayments for the full term of the loan. Whichever finance option you choose to apply for, you need to be sure that you can afford to pay the deposit, and keep up with your monthly repayments.

You should think about any changes to your situation that might occur during the term of the loan, which could affect your income or expenditure, for example – retirement, moving home, changing jobs, or any health issues.

You can be considered for finance if you:

Please remember that your application for finance isn’t guaranteed to be accepted, and that all applications are subject to status.

You’re in safe hands with our finance provider, Omni Capital Retail Finance. Omni was founded in 2009, is part of Castle Trust Group, and is one of the UK’s leading finance specialists. It is authorised and regulated by the Financial Conduct Authority (reference number 720279).

The process for making your purchase using finance couldn’t be easier.

Simply:

Omni will perform a 'soft' credit search on your credit file as part of their assessment, to determine whether the loan is affordable for you and if you are likely to make your repayments on time.

It’s important to know that an application for credit will only result in a ‘soft’ search on your credit file until the point your application for finance is complete, at which point a 'hard' credit check will be recorded on your credit file. Only you can see that a 'soft' search has been made on your credit file, but a 'hard' credit check will be visible to others viewing your credit file, for example, if you apply for credit in the future, the lender will see that an application credit search was made on your credit file.

Your application will be assessed based on eligibility, credit history and affordability and Omni will let you know the outcome in just a few seconds. Your application may be referred to a lender for manual assessment and you may receive a request for additional information to support your application.

Once your application is accepted you will be prompted to review and sign your credit documentation. This documentation will detail all the important information about your loan and should be read carefully.

You will receive a response from the Underwriter within 20 minutes of the application being referred during normal working hours. This can either be an accept, decline or a request for more information. If more information is requested, you will receive an email detailing the information required. If you have any questions, you can contact the Underwriting Team at [email protected].

If your application was declined, Omni may be unable to give you specific reasons why. Omni use information from your credit report, alongside your income and expenditure data to make a lending decision. You will receive an email which will provide further details of the Credit Reference Agencies and contact information for any queries you may have.

After your goods or services have been provided your loan will be activated. Your first Direct Debit payment will be taken approximately 30 days after you receive your welcome email from Omni. This will show on your statement as a payment to Omni.

You can request to change your monthly payment date after the first payment has been made by contacting Omni and speaking to their customer services team on 0333 240 8317. You will also be registered for their Customer Self Service portal, where you will be able to change the payment date yourself.

There are three ways to contact Omni:

There may be a fee for early repayment depending on the type of loan. Your Credit Agreement will detail the applicable fees for your product.

You have 14 days to cancel your credit agreement, please note that to cancel your goods and services you will need to speak to us directly. Cancelling your finance agreement with Omni without cancelling the goods and services will mean payment for the goods and services will still be required.

If you are unhappy with the level of service Omni have provided or anything Omni have done, you can let them know in the following ways:

Information about how Omni can support you if you miss a repayment can be found on the Omni website.

At Omni we want to draw our customers attention to several free and impartial debt advice services available to them:

Our customers may also benefit from the free Money Navigator Tool made available by the Money Advice Service to help provide further guidance on your finances.

To process your application, you will be asked to provide information about your personal, employment and financial situation. Omni Capital Retail Finance Limited will use your data to determine your finance offer. They will also perform a search with one or more Credit Reference Agencies to conduct checks for creditworthiness and any affordability assessments to help them make their decision.

You can find out more about how Omni Capital Retail Finance Limited uses and protect your personal data at https://www.omnicapitalretailfinance.co.uk/privacy-policy/.

Omni Capital Retail Finance Limited will provide you with a copy of their Privacy Policy with your loan documents.

Scott Country International is registered in England and Wales with company number SC433828.

Our Registered address is 221-223 King Street, Castle Douglas, DG7 1DT

Terms and Conditions

Scott Country International Terms and Conditions can be found at scottcountry.co.uk/terms-conditions

Scott Country International acts as a credit broker and offers credit products exclusively from Omni Capital Retail Finance. Scott Country International is authorised and regulated by the Financial Conduct Authority, registration number: FCA number 721544.

Finance is provided by Omni Capital Retail Finance Ltd which is a credit provider/lender. Scott Country International does not receive payment for introducing customers to Omni Capital Retail Finance.

Omni Capital Retail Finance Ltd finance options are subject to individual status, and terms and conditions apply. Your application will be subject to a credit check using a recognised credit reference agency as part of our assessment process. You can find Omni Capital Retail Finance's Terms and Conditions at omnicapitalretailfinance.co.uk

Omni Capital Retail Finance Ltd is registered in England and Wales with company number 7232938. Registered address: 10 Norwich Street, London, EC4A 1BD.

Authorised and regulated by the Financial Conduct Authority, Firm Reference Number: 720279.